Utilities Use Dark Money to Stop Climate Progress

Julian Moore

For years, the debate over what role power utilities should play in the energy transition was mostly relegated to the wonkier backwaters of energy policy.

But that was before evidence came to light showing how power companies have been using ratepayer money to lobby against there being any energy transition at all.

A report published in the Guardian last week found that American power utilities have spent more than $215 million on political lobbying through dark money groups, including to block laws promoting renewable energy.

This isn’t the first time that investor-owned utilities have been shown to influence climate policy, as InfluenceMap showed last year, but it's the first to put such a high figure on these efforts.

Big utilities lobbying against renewables seems contradictory when you consider that they stand to gain the most from recent climate spending bills. The Inflation Reduction Act created tax incentives for low-carbon hydrogen fuel production, carbon capture and low-carbon fuel production that overwhelmingly favor incumbent power companies.

That came after the 2021 Infrastructure Investment and Jobs Act (IIJA), which created schemes like the GRIP Program that set aside more than $10 billion specifically for big utilities to build a more resilient grid.

So with so many incentives to support utilities in their transition to renewables, why are power companies still spending ratepayer money to stop them?

Part of the answer is that some power companies want to have their cake at the federal level while eating it at the local level, too.

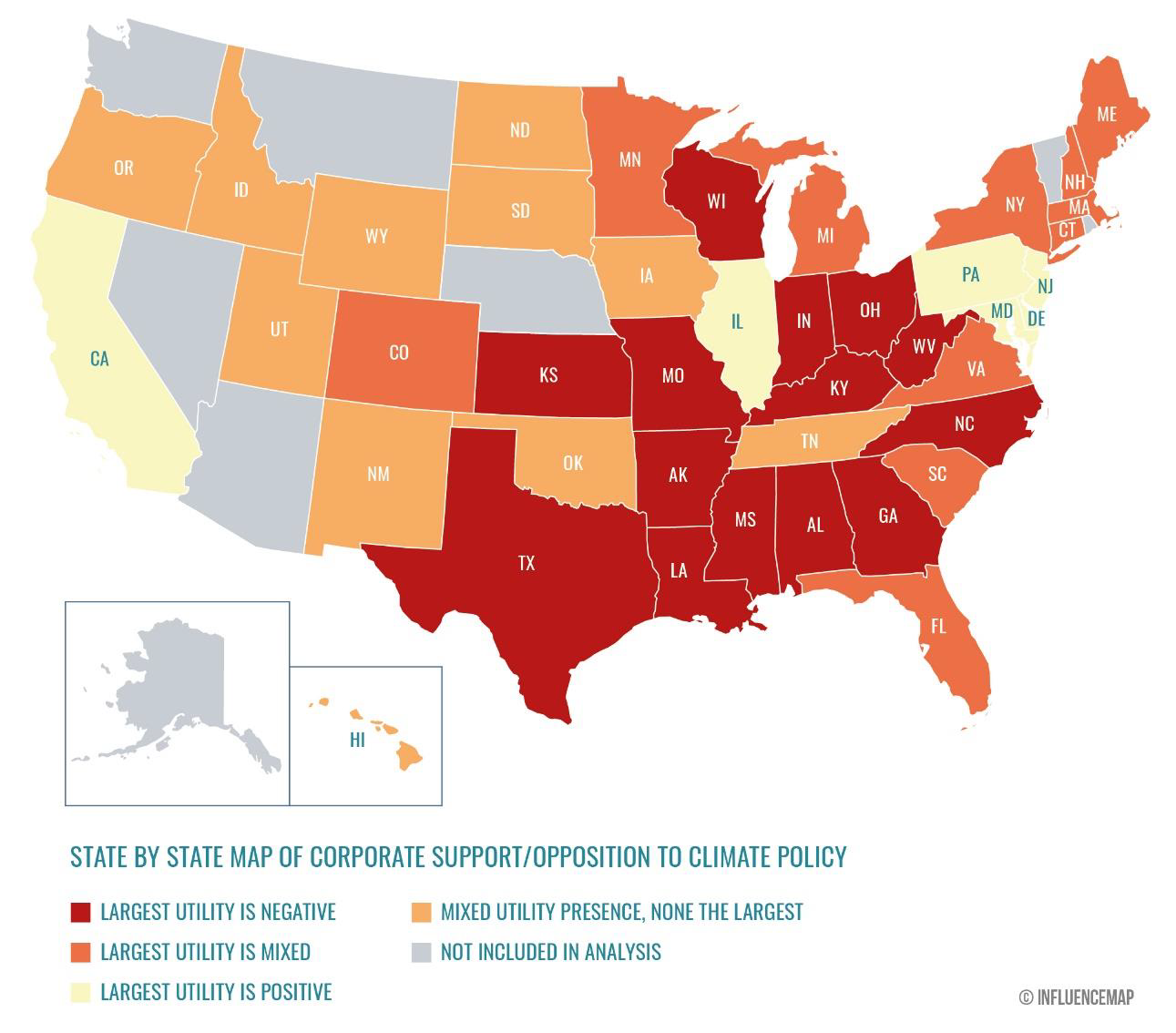

Most of the anti-climate lobbying reported in the Guardian and InfluenceMap was targeted at state and municipal laws, where state-wide power companies have far more political influence.

An InfluenceMap report from 2022 found that in states with little or no meaningful climate policy, nearly all power utilities in those states had lobbied against renewables. Such was the case in “red” states, like Alabama, Georgia and West Virginia. But even in Connecticut, where studying climate change is now compulsory in public schools, a Brown University study found that environmental groups were outspent 8-to-1 by business groups, including power companies, on climate legislation.

So while utilities may be happy to collect federal tax breaks handed down from Washington, most have tended to push back harder at home.

This contrast points to the shortcomings of tax incentives as a carrot for taking climate action, not that the point needed to be made.

Just look at the case of DC Solar, where a California mobile solar startup founder caught a 30-year sentence in federal prison for fraud after swindling investors out of nearly $1 billion.

DC Solar sold mobile solar units that did not work, and often did not exist, for years before being caught, in large part because most of their investors were interested in collecting a generous investment tax credit for solar projects, and never bothered to check if the company was producing anything other than thin air.

The DC Solar example is perhaps an extreme case, but highlights how well-intentioned tax incentives for climate solutions does not guarantee a good-faith effort to fight climate change.

It should be noted that some utilities in the InfluenceMap report stood out for their alignment with the Paris Climate Accords goals. Edison International, Exelon Corporation, and Public Service Enterprise Company each got high marks from InfluenceMap for their investments in wind, solar and energy storage.

Another reason that anti-climate lobbying goes unpunished is because the nature of dark money groups make them a perfect shelter for lobbying dollars.

Dark money political funds are typically structured as non-profit organizations, which creates a two-fold perception problem for the IRS when they enforce political spending rules. The tax agency is wary of pursuing political organizations in an age when accusations of politically motivated witch-hunts are at an all-time high.

And when they do, the penalties for such crimes pale in comparison to tax evasion. The low-return to high-risk ratio often confirms suspicions that the only reason for IRS investigations is political, so the agency has largely dropped its pursuit of dark money political funds.

EV Charging Debate

This is the context in which regulators in states and cities across the United States are debating whether utilities or private companies should take the lead in building charging networks to power the millions of EVs expected to hit American roads in the coming decade.

By 2030, 40% of new cars and trucks sold in the United States will be fully electric, far outstripping the current capacity of charging networks.

The Biden Administration has already put up $51 million to build chargers along federal interstates, but thousands more stations will need to be built to meet demand between and among cities.

The Charge Ahead Partnership, which consists of fuel retailers, grocery chains, convenience stores, and gas stations, argues that private businesses are best suited to build EV chargers. They believe that retailers with experience in selling products to consumers are more capable of providing reliable charging infrastructure.

Aside from their obvious financial interest, the group says they are concerned that electric utilities, with their established monopoly and access to ratepayer funds, will dominate the market and stifle charging startups like TerraWatt and Qwello.

Some states have imposed limits on utilities using ratepayer money for charging networks to ensure that private industry can operate in areas where utilities cannot. But in other states like Minnesota and Colorado, regulators are considering allowing utilities to bill ratepayers for EV charging infrastructure.

Proponents of utility-owned charging argue that utilities have the expertise and resources to make strategic investments in charging infrastructure. They also point out that private companies may not be able to serve certain areas, such as low-income apartment complexes, without utility involvement.

Apart from the ownership debate, unique intricacies of the EV charging business mean that utilities will have to re-write some common rules for charging startups to succeed.

Many utilities bill companies “demand charges”, which charge commercial users several times an hour to help regulate demand and keep the grid stable. But that is proving to be a challenge to the business model for EV charging.

Customers (understandably) want EV charging to go fast, requiring charging points to carry high power capacity despite a relatively low energy output per charge. Without re-negotiating these demand costs, EV charging stations will continue to face sudden price spikes and unpredictable costs for their customers without getting much in return per car charge.

As these debates play out across the United States, the first thing to position power companies in favor of climate solutions may well be the cripplingly expensive effects of climate change on everything utilities do today.

🌎 New Climate Jobs

Check out some of the latest featured jobs below. If you don't see anything that speaks to you, you can always go to Climatebase to explore thousands of other opportunities.

“Gridmatic Inc. is a high-growth ClimateTech startup based in the San Francisco Bay Area that is accelerating the clean energy transition by applying our expertise in data, machine learning, and energy to power markets. We are the rare startup that has 6 years of profitable growth without raising venture capital. Gridmatic is a great place to work with a culture ...”

- Vice President of Finance/ Controller (Cupertino, CA)

- Staff Engineer (Cupertino, CA)

- Retail Credit Facility Consultant (Texas)

- Recruiting and Operations Manager (Cupertino, CA)

- Quantitative Risk Manager (Cupertino, CA)

- Full-Stack Software Engineer (Cupertino, CA)

- Data Scientist (Cupertino, CA)

- AI Research Scientist (Cupertino, CA)

“At Verterra Energy, we're on a mission to harness the power in the worlds rivers, canals and oceans. To accomplish this, we are commercializing our first device called VOLTURNUS, a pioneering water-power technology that deploys in harmony with the current to capture baseline, zero emission electricity. ...”

- Office Administrator (Saint Paul, MN, USA)

- Mechanical Engineer (Saint Paul, MN, USA)

Smart Energy for Europe Platform (SEFEP)

“Energy systems worldwide are undergoing rapid changes. Most countries have now set themselves climate neutrality targets, but the challenges are manifold: It's about grids and markets, regulation and system integration, structural change and a just transition. In a nutshell, it's about reinventing energy systems. This is where we get involved. As Agora Think Tanks, we are pursuing the goal of ...”

- Manager Press and Communications Southeast-Asia (f/m/d) (Bangkok, Thailand)

“Deep Sky is a carbon dioxide removal (CDR) project developer in Canada that seeks to slow, arrest and ultimately reverse the accelerating march towards global climate disaster through carbon removal and long-term storage. In partnership with leading carbon capture technology developers from around the world, Deep Sky will build infrastructure to capture and permanently sequester carbon dioxide from the atmosphere ...”

- Senior Carbon Storage Engineer (Remote (Montréal))

- Senior Mineralization Engineer (Remote (Montréal))

- Head of Project Engineering (Remote (Montréal))

- Senior Carbon Capture Engineer (Remote (Montréal))

“At Presto, we are creating mobile solutions for electric fleets to provide their drivers with seamless, reliable, and cost-effective charging while growing utilization for charging owners and networks. We believe charging should be ubiquitous, reliable and affordable and will relentlessly improve the charging customer experience. Presto is backed by Congruent Ventures, Powerhouse, and prominent climate-tech angel investors. The founding team has ...”

- Launch Manager - Los Angeles (Los Angeles, CA, USA)

- Senior Software Engineer, Mobile (Remote (Chicago, IL, USA))

- Senior Software Engineer, Platform (Remote (Chicago, IL, USA))

“Tigo is the worldwide leader in Flex MLPE (Module Level Power Electronics) with innovative solutions that increase energy production, enhance safety, and decrease operating costs of solar installations. Tigo's TS4 platform maximizes the benefit of PV systems and provides customers with the most scalable, versatile, and reliable MLPE solution available. Tigo was founded in Silicon Valley, California in 2007 to ...”

They are hiring across the following departments:

- Customer Success

- Sales & BD

- Power Engineering

- Sales Engineering

- Software Engineer

- Operations

- Project Management

- Product Management

- Marketing

“Prometheus Materials provides sustainable building materials that accelerate the world's transition to a carbon-negative future. ...”

- Director of Product Management (Longmont Colorado, Longmont, CO, USA)

“Since 2000, Native has worked with clients to develop authentic solutions to their sustainability challenges and to implement community-scale projects that reduce greenhouse gas emissions, strengthen clients’ businesses, and contribute to progress on climate change around the world. We construct unique project portfolios to meet climate goals, drive business value, and deliver tangible benefits to stakeholder communities – from customers and ...”

- Intern, Asset Management (Paid) (Burlington, VT, United States)

- Analyst, Geospatial Analysis (Bozeman, MT, United States)

- Business Administrator (Burlington, VT, United States)

- Manager, Data Systems (Burlington, VT, United States)

“RMI is an independent nonprofit founded in 1982 that transforms global energy systems through market-driven solutions to align with a 1.5°C future and secure a clean, prosperous, zero-carbon future for all. We work in the world’s most critical geographies and engage businesses, policymakers, communities, and NGOs to identify and scale energy system interventions that will cut greenhouse gas emissions at ...”

They are hiring across the following departments:

- Climate Solutions

- Events

- Associates

- Marketing

- Carbon Markets

- Finance

- Data

- Program Management

- Operations

- Communications

“Seabound is a climate tech startup that builds carbon capture equipment for ships. The equipment is installed adjacent to a ship's funnel to trap up to 95% of the CO2 from the exhaust, using patent-pending technology. ...”

- R&D Thermal Fluids Engineer (London)

“Heirloom is on a mission to restore balance to our atmosphere. We are removing 1 billion tons of carbon dioxide by 2035, using natural processes to engineer the world's most cost-effective Direct Air Capture solution. Naturally occurring minerals - alongside forests, soils, and the ocean - are one of our planet's most vital carbon sinks. Over geological timescales, carbon dioxide ...”

- Production Technician (Brisbane, CA)

- Maintenance Technician (Tracy, CA)

- Machine Shop Manager (Brisbane, CA)

- Controls Project Engineer (Brisbane, CA)

- Lead Modeling and Simulation Engineer (Brisbane, CA)

- Analytical Chemist (Brisbane, CA)

- Environmental Health and Safety Specialist (Tracy, CA)

- Mechanical Design Engineer - Automation (Brisbane, CA)

- Office Manager (Brisbane, CA)

- Head of Legal (Brisbane, CA)

- Senior FP&A Lead (Brisbane, CA)

- Senior Process Development Engineer, Data Science (Brisbane, CA)

- Senior Research Scientist (Brisbane, CA)

“Kaluza is the intelligent energy platform enabling the world’s largest energy companies to lead the way in the energy transition. From revolutionising energy retail operations to smart electric vehicle charging, our software is empowering energy suppliers to deliver market-leading experiences for their customers and drive decarbonisation. Launching in 2019, we’ve grown rapidly to over 400 employees across the UK, Portugal and ...”

- Workplace Coordinator - Part Time (12 Month FTC) (Edinburgh, Scotland, United Kingdom)

- Head of Quality (London, England, United Kingdom)

- Finance Data Analyst (London, England, United Kingdom)

- Software Engineer TL1 - Flex (London, England, United Kingdom)

- Enterprise Architect (London, England, United Kingdom)

- Content Designer (London, England, United Kingdom)

- Product Lead - Metering and Industry (London, England, United Kingdom)

- OEM Partnerships and Alliances Lead EMEA (London, England, United Kingdom)

- Software Engineering Manager - Flex (London, England, United Kingdom)

- Account Executive (Chicago, Illinois, United States)

- Account Executive - East Coast (Washington DC)

“We are designing waste out of the human experience. Pela has been around for over 10 years and has helped over 1 million customers make the switch to more eco-friendly products. Pela is famous for being the creators of the world's first compostable phone case, Apple watch strap + AirPods case, and has now launched our flagship smart waste product ...”

- Product Design Lead (P/T Contract) (Remote (Kelowna, BC))

- Senior Graphic Designer (Remote (Kelowna, BC))

- Director of Retail & Distribution Sales (Remote (Kelowna, BC))

- Director of Marketing (Remote (Kelowna, BC))

- Brand Marketing Strategist (Remote (Kelowna, BC))

- Sr. UX Designer (Remote (Kelowna))

- Integrations Specialist (eCommerce) (Remote (Kelowna, BC))

- UX Director (Remote (Kelowna))

“Isometric builds scientifically rigorous measurement and verification technology to confirm carbon removal claims are true. ...”

- Marine Biologist (New York City)

- Communications Lead - London (London)

- Senior or Staff SRE Engineer (London)

- Lead Auditor (London)

- Business Development Manager (London)

- US Policy Manager (New York City)

- EU Policy Manager (London)

- Geochemist - Enhanced Weathering (New York City)

- Geologist - Subsurface Storage (New York City)

- Biomass-based Carbon Removal Scientist (New York City)

- Communications Lead - New York (New York City)

- Carbon Removal Scientist or Engineer (New York City)

- General Application (London)

- Senior or Staff Platform Engineer (London)

“Blue Whale Materials is an American recycling company working toward a greener and more sustainable global battery supply chain. It is building a lithium-ion battery recycling facility, producing an ethically sourced stream of cobalt, nickel, manganese, and lithium in the first stage of a closed-loop solution for lithium-ion battery manufacturers. ...”

- Strategy and Corporate Development Associate (Remote (NY, New York))

“At Zero, we are changing the paradigm of how homeowners plan and purchase energy upgrades for their homes. We are streamlining today’s time-intensive and often frustrating process with a self-serve experience that delivers actionable intelligence to homeowners so they can get their projects done without all the hassle. To make this happen, we have created a holistic software platform that ...”

- Senior Software Engineer (Denver, CO, USA)

- Home Electrification Advisor (Denver, CO, USA)

“Synapse Energy Economics, Inc. is a research and consulting firm specializing in economic and policy research, modeling, and analysis to provide energy sector and climate solutions. Our work supports a broad range of public interest clients, including consumer advocates, environmental organizations, regulatory commissions, and state and federal agencies. Synapse produces expert reports and data analysis for these clients and represents ...”

- Senior Associate, Grid Modernization (Cambridge, MA, USA)

- Senior Associate, Energy Efficiency (Cambridge, MA, USA)

- Associate, Energy Efficiency (Cambridge, MA, USA)

- Associate, Grid Modernization (Cambridge, MA, USA)

Compact Membrane Systems, Inc.

“Compact Membrane Systems (CMS) is on a mission to save the planet. We create technology to capture and reduce greenhouse gas emissions, avert global warming, and transform industry into a long-term sustainable enterprise. One membrane system at a time. CMS is a high-growth, advanced materials company based in Wilmington, Delaware that offers its employees personal growth, autonomy, and the opportunity to ...”

- Process Engineer (335 Water Street, Wilmington, DE, USA)

- R&D Team Member (ChemE) (335 Water Street, Wilmington, DE, USA)

- Laboratory Technician (335 Water Street, Wilmington, DE, USA)

- Fabrication Technician (335 Water Street, Wilmington, DE, USA)

- Olefins Product Manager (Remote)

- Business Development Lead - Olefins (Remote (Houston, TX, USA))

- Business Development Lead- Carbon Capture (335 Water Street, Wilmington, DE, USA)

- Carbon Capture Project Coordinator (335 Water Street, Wilmington, DE, USA)

“San José Clean Energy, or SJCE, is San José’s local, not-for-profit electricity supplier operated by the City of San José. Since 2019, we have provided clean energy for residents and businesses at competitive rates, while also offering community programs, local control, and more transparency and accessibility. Our community is at the core of what we do. Y ou’ re mak ing ...”

- Regulatory Policy Specialist (Power Resources Specialist I/II) - Community Energy Department - (2300705) (San Jose, CA, USA)

- Regulatory Policy Specialist (Power Resources Specialist I/II) - Community Energy Department - (2300400) (San Jose, CA, USA)

- Power Resources Specialist I/II - Power Resources Division, SJCE - (2300467) (San Jose, CA, USA)

“Spoiler Alert is a Boston-based software company helping perishable CPG brands manage excess and slow-moving inventory. Working exclusively at the manufacturing plant or distribution center level, Spoiler Alert offers a best-in-class B2B sales platform that enables food & beverage brands to manage their liquidation processes across a private network of discount retailers and nonprofit channels - with a heavy focus ...”

- Enterprise Customer Success Manager (Remote (Remote))

- Enterprise Sales Executive (Remote (Remote ))

- Future Opportunity at Spoiler Alert (Remote (Remote))

That's it for this week! Remember, you can always view thousands of more jobs on Climatebase.org.

Final reminders...

👋 Get discovered. Create a profile to have employers hire you.

🚀 Accelerate your climate career. Apply to join the Climatebase Fellowship.

🌱 Hiring? Post your jobs to reach over 200k monthly users users and over 70,000 newsletter readers

❤️️ Share a link to this week's edition

🐦 Let's connect! Follow us on Twitter @Climatebase, and our co-founders @evandhynes and @jhardin925

The Author

Julian Moore

All Stories

In today's edition of This Week in Climate, we look at the LA fires and a warning for the future.

In today's edition of This Week in Climate, we look at big banks moving on from climate commitments

Today's edition of This Week in Climate looks at the political coalitions keeping climate action alive.

In today's edition of This Week in Climate, we look at the bright spots for climate in 2024.

In today's edition of This Week in Climate, we look at the plastics treaty that wasn’t.